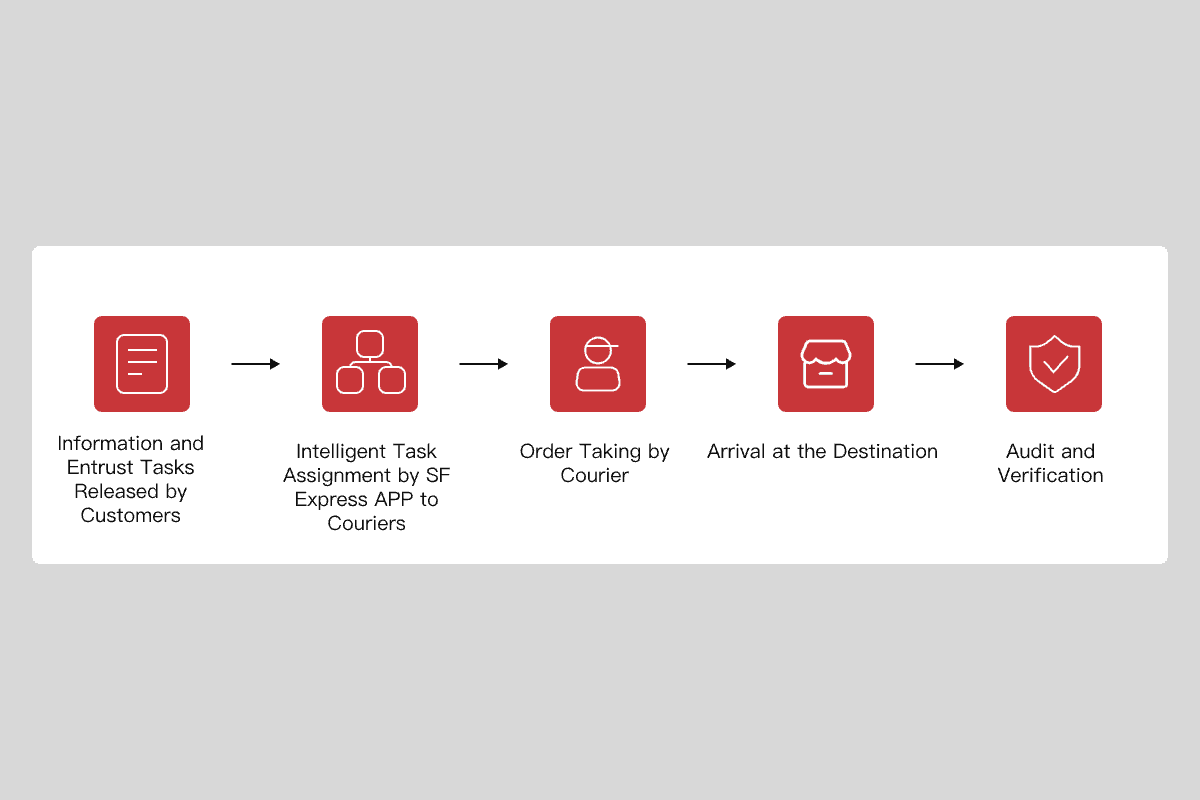

Solutions for Information Audit

In accordance with the risk compliance requirements of the banking industry, once an enterprise account is opened, we assist banks by collecting on-site information such as the office address and business license of the enterprise, returning the information to the bank in photographic form to verify the authenticity of the enterprise's information, thus mitigating the risk associated with banking operations

Diversifying Ordering Modes

We support both our self-developed system for placing orders and the docking with the banking system for placing orders. With extensive experience in docking with multiple bank headquarters, we have stable delivery capabilities throughout the whole process of order placement - order modification - order checking - order review

Providing Efficient Response

We enable order placement at any time of the day and accept orders within 2 to 4 hours, fully satisfying the T3 account opening time requirements of banks

Ensuring Quality through Dedicated Customer Service Teams

We ensure that every order is reviewed and guarantee the integrity and validity of the photos collected on-site and the research information

Assisting Banks in Building Risk Control Models

Based on the internal risk control requirements of banks, we customize survey forms to identify suspected risky enterprises, thus assisting banks in balancing internal management and business expansion

Corporate Account Services for Bank Customers

Personal Credit Services for Bank Customers